14 May What is financial econometrics?

Financial Econometrics is “the application of econometric techniques to problems in finance” (Brooks, 2008). Econometrics is a set of statistical techniques to interpret economic phenomena through data and, in particular, to assess whether and how two economic phenomena (government policies, firms’ performance, etc.) are related. Financial econometrics are useful in determining relationships between prices of financial assets, as well as, assessing whether a specific metric may be useful in predicting the change in prices. In brief,:

- Understanding simple relation is beneficial (typically, the price of a stock is higher if its price is negatively correlated with price of market portfolio).

- Assessing if a measure (firm size, capital ratios, national debt/GDP, etc.) predicts changes in prices. This is useful to design profitable trading strategies.

Typical financial econometrics problems:

- Testing whether financial markets are informationally efficient

- Testing whether the CAPM or APT represent superior models for the determination of returns on risky assets

- Measuring and predicting the volatility of bond returns

- Explaining the determinants of bond credit ratings used by the ratings agencies

- Modelling long-term relationships between prices and exchange rates

What are the Special Characteristics of Financial Data?

Frequency & quantity of data: stock market prices are measured every time there is a trade or somebody posts a new quote.

Quality: No possibility for measurement error (financial theories mainly deal with prices, returns, volatilities, etc.) but financial data are “noisy”. Recorded asset prices are usually those at which the transaction took place.

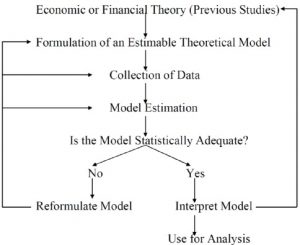

Steps involved in the formulation of financial econometrics models

Sorry, the comment form is closed at this time.