30 May Finding the IPO Sweet Post

“Get big fast” has been a start-up mantra since the 1990s. Many VCs try to grow their companies quickly in order to raise as much capital as possible; having a cash hoard, the thinking goes, gives a start-up greater flexibility and more power to fend off potential rivals.

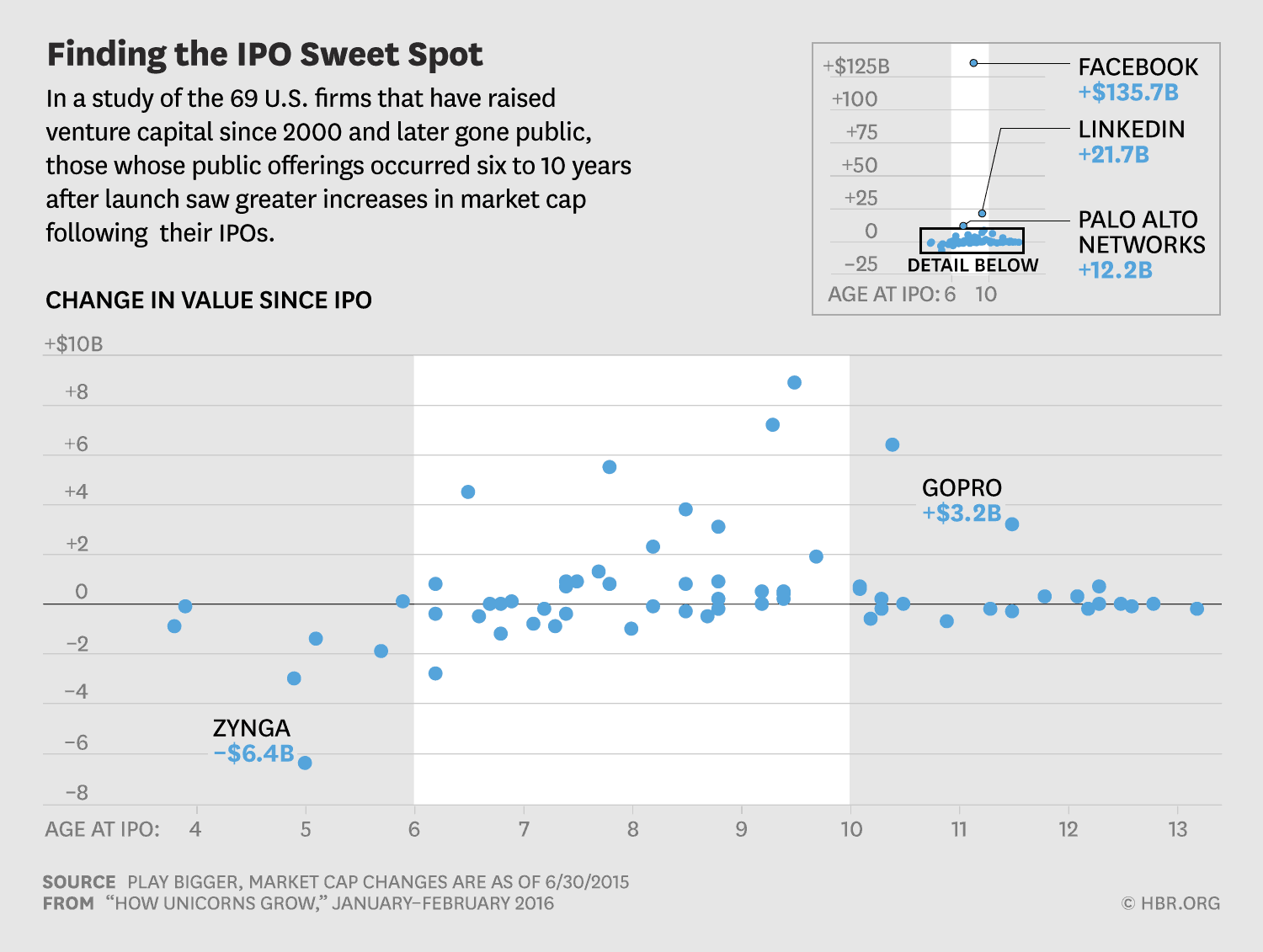

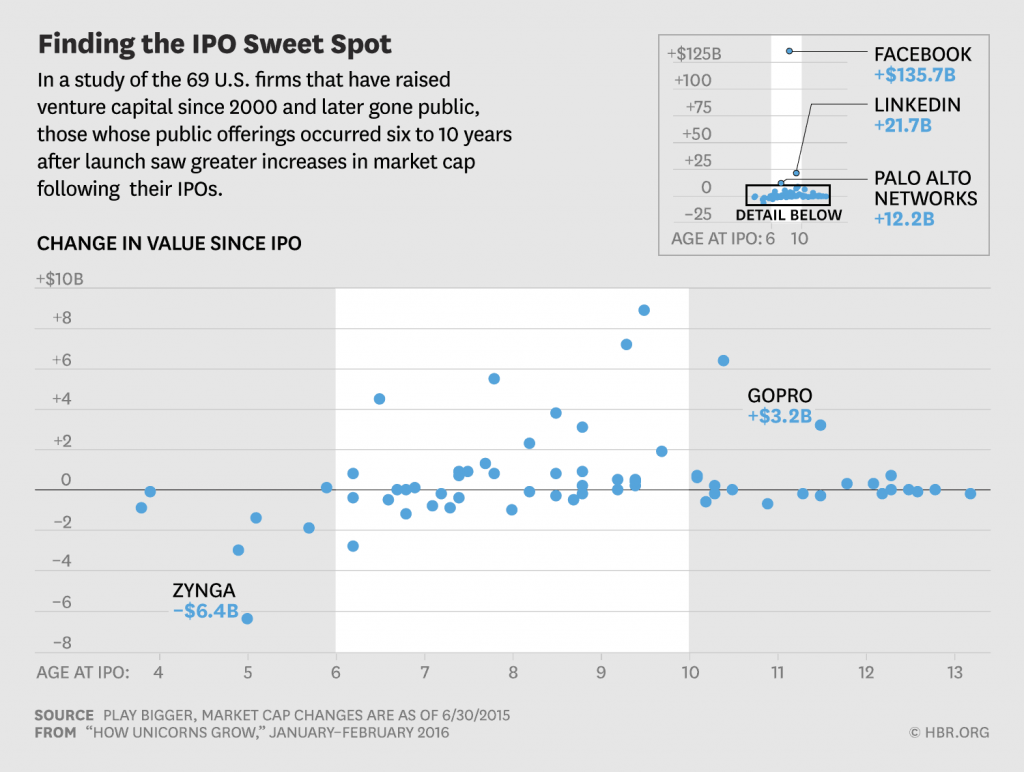

In a study of the 69 U.S. firms that have raised venture capital since 2000 and later gone public, those whose public offerings occurred six to 10 years after launch saw greater increases in market cap following their IPOs.

Tech start-ups are in a race to define new product categories, and the pace has quickened. Simply raising more money isn’t enough to win that race—and going public too soon or too late may limit long-term success. Even for unicorns, the path forward can be a challenge.

FROM: How Unicorns Grow

AUTHOR: Harvard Business Review

SOURCE: Play Bigger, Market Cap Changes are as of 6/30/2015

No Comments